Revolutionising the Australian financial services industry.

Learn how Radial can deliver insights for your business

Revolutionising the Australian financial services industry.

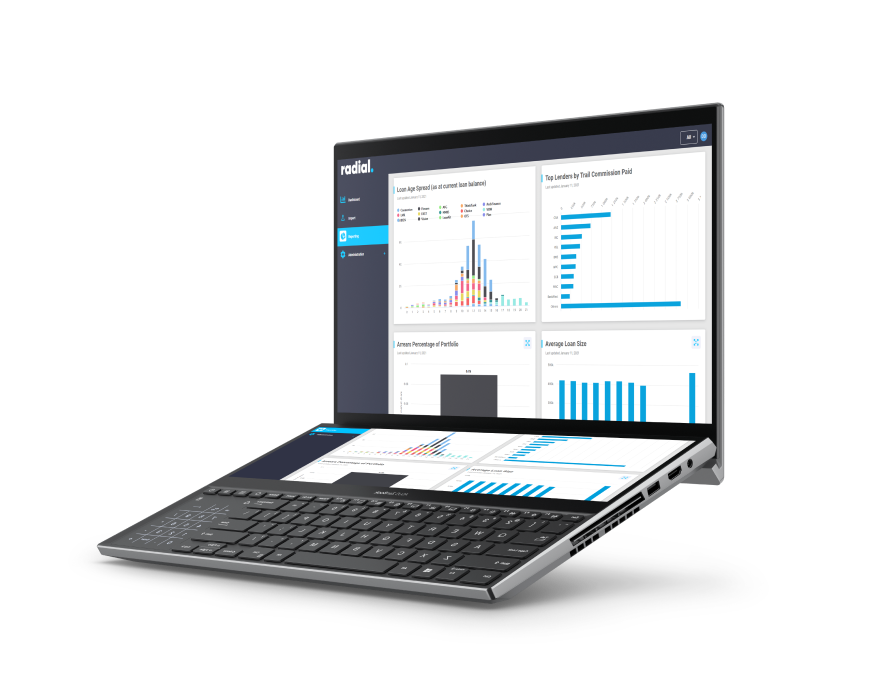

Radial is a cloud-based data and analytics platform that efficiently automates the capture of customer, loan & commission data for the financial services industry.

What is Radial?

Our belief is that all successful businesses are built upon great

information. Radial is the premier provider of data analytic tools for the financial services industry, with intuitive and predictive cloud and mobile technology.

Testimonials

Neil Carstairs

Mortgage Corp, Wantirna South, VIC

I just want to let you know after our discussion the other day how impressed I was with your service, on the turnaround time, response, the data insights provided and your professional overview/ opinion on my information provided.

I’m happy to provide any support & overwhelming positive opinion and I hope this helps in working with new clients, in fact I think this business opportunity will go further.

Mark Rogan

General Manager / Finance Broker Artisan Finance

The implementation of the Radial platform for our business has allowed us to have, on one place, complete visibility of our client base across all lenders, including those we hold direct accreditation with.

The reporting functionality allows us to easily track our business flows both from a book growth and runoff perspective and analyse risks accordingly – all from our phone

This ability allows us to better understand our business and where we need to deep dive to understand better. It’s an invaluable tool.

2025 Gerard Hansen – FinVu

We’ve recently been using the Radial platform to assist our business undertake due diligence on trail books we’ve been interested in purchasing.

To me it’s my Sat Nav ….it’s the road map of the business.

What’s become quite apparent is the level of detail & insights generated from this system that has enabled us to form views on what value we’re prepared to offer. By better understanding the key risks and opportunities allows our team to better prepare a refined onboarding process to ensure the transition of relationships. The concept of key customers, concentration

risks and loan age profiling visualises quickly what needs to be done. Overlaying this is predictive analysis on trail income for the next 3-5 years using historical data as the pattern for future financial growth.

Without doubt, this platform has been a valuable tool, both in the acquisition phase and post settlement monthly monitoring. We highly recommend this system to anyone seriously considering acquiring a portfolio or needing a monthly monitoring service.

Mortgage Brokers

We provide the 16,000 individual mortgage brokers who are working in loan origination a highly efficient platform to grow their business and potentially scale to a corporate identity.

Mortgage Brokers

Relationship Management We collect and consolidate Customer contact points, loan product information and commissions received from multiple aggregator sources, which is presented in a standardised format.

Business Insights Accessing historical commission information enables our platform to provide predictive trend patterns of revenue for 3 to 5 years. The system also enables peer to peer comparison.

Visualisation of DataRadial provides a sophisticated snapshot of brokers comprehensive business insights with a simple, all-in-one, data management solution.

Identify OpportunitiesUnderstanding patterns of past performance allows Brokers to proactively plan and target new business. Plus, Radial produces meaningful task lists for customer retention purposes.

Features

Data Security and services

– Secure network infrastructure

– Data stored in Australia

– Multi-factor authentication

– Data encryption services

Integration

– Open architecture technology

– Single or bi-directional API integration

– Built-in integration to multiple aggregator platforms

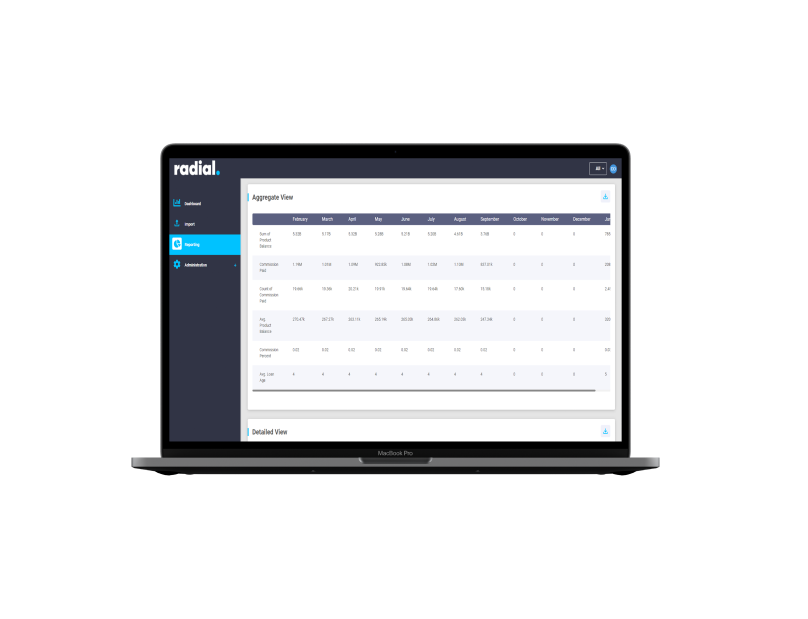

Data Insights

– Real time reports and dashboards

– Consolidated and granular reporting

– Customer views and date range based on user profiles

– Drag and drop file lodgement for immediate reporting

Accessibility

– Cloud based technology

– Single sign-on

– Compatible on desktop, mobile and tablet

– Configurable user permissions and hierarchy

Lenders

Radial provides 50+ lenders who operate in the Australian mortgage market a complete data management platform, standardising the distribution of commission payments to the multiple Aggregators and mortgage brokers with direct lender accreditations.

Lender Benefits

Cloud based platformEnables automatic software updates avoiding software redundancies and version incompatibilities.

Off-the-shelf platformLenders wishing to be introduced to intermediated loans through mortgage brokers can access a built for purpose solution.

Integration Templated data collection enabling efficient integration with aggregator software platforms, streamlining the end to end process.

Features

Data Security and services

– Secure network infrastructure

– Data stored in Australia

– Multi-factor authentication

– Data encryption services

Intergation

– Open architecture technology

– Single or bi-directional API integration

– Built-in integration to multiple aggregator platforms

Data Insights

– Real time reports and dashboards

– Consolidated and granular reporting

– Customer views and date range based on user profiles

– Drag and drop file lodgement for immediate reporting

Accessibility

– Cloud based technology

– Single sign-on

– Compatible on desktop, mobile and tablet

Aggregators

Radial provides the 20+ mortgage aggregators who operate in the Australian mortgage market a complete data management platform, standardising the distribution of commission payments to their sub-aggregators and accredited mortgage brokers.

Aggregators Benefits

Cloud based platformEnables automatic software updates avoiding software redundancies and version incompatibilities.

Off-the-shelf platformAggregators wishing to be introduced to intermediated loans through mortgage brokers can access a built for purpose solution.

Integration Templated data collection enabling efficient integration with aggregator software platforms, streamlining the end to end process.

Features

Data Security and services

– Secure network infrastructure

– Data stored in Australia

– Multi-factor authentication

– Data encryption services

Integration

– Open architecture technology

– Single or bi-directional API integration

– Built-in integration to multiple aggregator platforms

Data Insights

– Real time reports and dashboards

– Consolidated and granular reporting

– Customer views and date range based on user profiles

– Drag and drop file lodgement for immediate reporting

Accessibility

– Cloud based technology

– Single sign-on

– Compatible on desktop, mobile and tablet

Monthly Reporting

Our monthly reporting helps to manage the accumulation, run off and management of your portfolio.

Being informed helps you make the right decisions. Our reports include:

- Lender spreads

- Top 10 customers by trail income

- Trail & upfront income segregation

- Arrears management as a percentage of portfolio

- Average loan size

- Loan age spread across your aggregated portfolio

Radial Keeps Track Of Information

Comparative Analysis

Visualises how & what areas they can improve & outperform their peers.

Improve Automation

Digitisation of customer, loan & commission management systems allowing brokers to drive client communication, retention and growth.

Trend Analysis prepares your journey